Disclaimer: This website is a dedicated campaign landing page created and operated by First Global Bank Limited for the Platinum Plus Credit Card Promotion. It is not the official corporate website of First Global Bank Limited. For the official website, please visit https:/firstglobal-bank.com. Some images displayed on this page are for illustrative purposes only and do not represent actual products, individuals, or locations. All data submitted on this site is encrypted and transmitted securely via HTTPS.

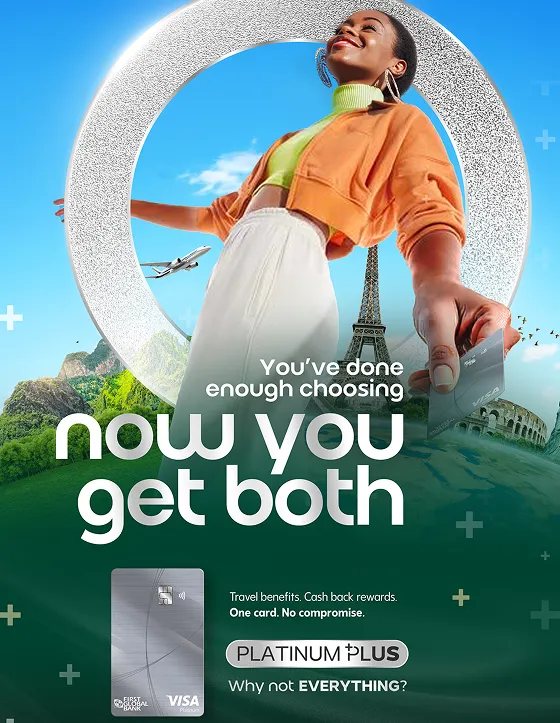

Why not EVERYTHING?

FGB Visa Plutinum Plus Card

No Credit Check Required

FGB Visa Platinum Plus Card

Limited Time Offer

$0 Annual Fee For The First Year*

$14,000 annual fee | 45% yearly interest rate* | Additional card: First is free*

Platinum Plus Lifestyle

Platinum Plus is the lifestyle card for those who refuse to choose. You work hard and live well, and this card moves with you. One minute you’re closing deals in Kingston, the next you’re sipping champagne in Miami. From boutique dinners to last-minute flights, concierge bookings to cashback rewards, Platinum Plus isn’t about showing off, it’s about showing up for the life you’ve built.

Confident, seamless, elevated. No waiting. No compromise.

Just access to the best of both worlds because you deserve a card that matches your ambition.

Card Features

2% Cashback on select categories (Grocery, Utilities, Restaurants and Travel)

1% Cashback on all other transactions

Access to exclusive 390 world-class restaurants including the Michelin network

SkyBox discount included

2 months of Bloomberg included

Purchase Protection up to USD 10,000

Get extended warranty protection up to USD 10,000

Price Protection up to USD 2,000

Real-time transaction alerts for fraud prevention

Billed in JMD

Complimentary Lounge Visits

Access 1,300+ airport lounges worldwide with Priority Pass

Platinum Concierge Service

From Kingston to Cannes—travel bookings, dining, lifestyle support

Luxury Hotel Privileges

Room upgrades, late checkout, and breakfast via Visa Luxury Hotel Collection

Platinum Circle Invitations

Access to exclusive cardmember-only experiences

Emergency Medical Coverage

Up to USD $170,000 for treatment and emergencies while abroad

Visa Online Medic

Global doctor access, non-emergency support, prescription coordination

Platinum Plus Travel

Platinum Plus turns every trip into a power move. Whether it’s a quick island escape or a jet-set run to a fashion capital, this card travels like you do, first class in mindset, even if not in seat. With travel concierge, emergency assistance, global VISA privileges, and real cashback on every tap, it’s your passport to premium experiences without the premium effort. No currency games. No conversion math. Just one sleek JMD card that unlocks the world, rewards your rhythm, and lets you land like you never left your standard behind.

Travel Benefits

International Emergency Medical Services up to USD 170,000

Accidents happen—you're covered for urgent care, even abroad

Cardholder plus anyone for whom the cardholder has purchased a ticket with an eligible Visa card

Benefits are offered to additional cardholders

It covers the repair or replacement of the item up to the maximum limit established by card

24/7 access to licensed doctors through video or audio chat

This service is available for non-emergency incidents

If the service is in the US, fulfillment of prescriptions if needed to the closest pharmacy

Urgent card replacement (within 24hrs in USA & Canada, 3 working days for all other countries)

VISA Digital Concierge (Guidance to pay for hotel and other amenities provided by VISA)

VISA Airport Companion (Entrance to VIP lounges with digital membership. Discounts at stores and restaurants, along with other amenities)

Enjoy VIP comfort at 460+ airports. Powered by Visa

1,280 lounges worldwide. Luxury follows wherever you fly

VIP Perks at premium hotels & resorts within the Visa Luxury Hotel Collection*

Upgrades that greet you at check-in

Wake up to complimentary breakfast, every morning

Your stay lasts longer with late check out until 3PM

Purchase Protection

Up to USD $10,000

Price Protection

Up to USD $2,000

Extended Warranty

Get up to double the coverage on eligible items

Real-Time Fraud Alerts

Instant activity notifications

Urgent Card Replacement

24 hours (US/Canada), 3 days internationally

Billed in JMD

No currency conversion required

Luxury Travel Perks

Turn every trip into a power move

VIP Lounge & Airport Access

Skip crowds & unwind in 1,280+ VIP lounges worldwide.

Jet smarter with discounts at 450+ international airports.

Premium Hotel Upgrades

Room upgrades & continental breakfast.

Sleep in & check out late

Access VIP perks at VISA Luxury Hotels at no extra cost.

Michelin-Star Dining & Luxury Concierge

Dine at Michelin-star restaurants.

Earn 2% cashback every time you eat out.

Let your concierge book the table everyone wants

Luxury Lifestyle Perks

For those who refuse to choose

Smart Shopping

2% Cashback is on Grocery, Utilities, Restaurants and Travel

1% on all other transactions

Spend in JMD. No hidden foreign exchange surprises.

Shop safely with real-time alerts and fraud protection.

Premium Subscriptions

Enjoy free Bloomberg for 2 months

Shop U.S. stores globally with your discounted Skybox subscription

Exclusive Events & VIP Memberships

Get invited to concerts, fashion shows, and culinary nights.

Secret experiences & VIP access within the Platinum Circle.

Live the lifestyle with access to exclusive events, curated just for you.

Step Into The Platinum Circle.

With the FGB Platinum Plus Credit Card, enjoy luxury travel benefits plus cashback,

plus lifestyle protection—no points, no minimums. Just tap and go.

1280+

VIP lounges worldwide

1-2%

cashback on purchases

460

international airport lounge access

380

exclusive restaurants worldwide

Apply Now for Platinum Plus

With the FGB Platinum Plus Credit Card, enjoy luxury travel benefits plus cashback, plus lifestyle protection. No points, no minimums. Just tap and go.

Min. Gross Monthly Income

JMD 500,000

Annual fee

JMD 14,000

Effective Annual Interest Rate

45% - 49.35%

Cashback Rewards

2% Cashback on Grocery, Utilities, Restaurants and Travel

1% on all other transactions

Travel Rewards

VIP Lounge & Airport Access

Premium Hotel Upgrades

Michelin-Star Dining & Luxury Concierge

Protections

Purchase Protection up to USD 10,000

Price Protection up to USD 2,000

Extended warranty protection up to USD 10,000

Urgent card replacement

Locally and Internationally accepted

Step Into

The Platinum Circle.

With the FGB Platinum Plus Credit Card, enjoy luxury travel benefits plus cashback, plus lifestyle protection. No points, no minimums. Just tap and go.

Min. Gross Monthly Income

JMD 500,000

Yearly fee

JMD 14,000

Effective Annual Interest Rate

45% - 49.35%

Cashback Rewards

2% Cashback on Grocery, Utilities, Restaurants and Travel

1% on all other transactions

Travel Rewards

VIP Lounge & Airport Access

Premium Hotel Upgrades

Michelin-Star Dining & Luxury Concierge

Protections

Purchase Protection up to USD 10,000

Price Protection up to USD 2,000

Extended warranty protection up to USD 10,000

Urgent card replacement

Locally and Internationally accepted

Step Into The Platinum Circle.

With the FGB Platinum Plus Credit Card, enjoy luxury travel benefits plus cashback, plus lifestyle protection. No points, no minimums. Just tap and go.

1280+

VIP lounges worldwide

2%

Cashback is on Grocery, Utilities, Restaurants and Travel

1% on all other transactions

460

international airports at special rates

380

exclusive restaurants worldwide

Eligibility Criteria

You’re likely eligible if you:

✔ Are employed for 6+ months or have 1 year in business

✔ Can provide:

- Valid national ID & TRN

- Proof of address

- Recent job letter & 3 months’ pay slips

- Completed application & signed consent form

Minimum Credit Limit: JMD $500,000

Maximum Limit: Up to JMD $4,000,000 (based on review)

VIP Lounges Access, First Class Flight Upgrades,

Everyday cashback

From purchase protection to emergency medical coverage, the FGB Platinum Plus

Credit Card has your back—plus transparent rates, no surprises.

No Annual free for the first year if you are already a FGB customer*

Offer Details | Pricing & Terms

$14,000 annual fee | 45%* yearly interest rate | Additional card: First is free*

This offer may not be available to applicants who currently hold an active Platinum Plus Visa card, or who have previously received a welcome bonus for this product. Eligibility for the introductory offer and benefits—including no interest fees for the first 12 months—may also be determined based on your existing credit facilities with First Global Bank and your recent account activity. Approval is subject to credit and income verification, and other standard lending criteria.

No Annual Fee for the First Year

Apply now and enjoy premium benefits without the cost-

for a limited time only.

You’re Not Applying. You’re Stepping In.

With the FGB Platinum Plus Credit Card, enjoy travel benefits, Kingston exclusives, and

lifestyle protection—no points, no minimums. Just tap and go.

VIP Lounge Access

• Entry to over 1,280 airport lounges worldwide

• Access powered through Visa Airport Companion App

First-Class Flight Upgrades

• Get upgraded treatment — from check

in to touchdown

• Premium hotel benefits through the Visa Luxury Hotel Collection

• Room upgrades

• Late checkout

• Continental breakfast

Prestige Across Jamaica

• Access exclusive venues and fine dining in Kingston

• Preferred status with select partners — no extra steps needed

Visa Concierge & Global Support

• 24/7 assistance with travel, dining, reservations, and emergencies

• Real-time fraud alerts and transaction tracking

Everyday Cashback

• Earn on what matters most — dining, travel, bills, and more

• Paid back in Jamaican Dollars (JMD)

Confidence Comes Standard

From purchase protection to emergency medical coverage, the FGB Platinum Plus

Credit Card has your back—plus transparent rates, no surprises.

Built-In Protection

- Here's some stuff

Price Protection: up to USD $2,000

Extended Warranty: up to USD $10,000

Emergency Medical Services: up to USD $170,000

Visa Online Medic Access worldwide

Rates & Fees

First card is free; JMD $7,000 after

Annual Fee: JMD $14,000 (Waived in Year 1)

Interest Rate: 45%

Late Payment Fee: JMD $3,000

Overlimit Fee: JMD $3,000

Cash Advance: 10%

Ready to Step In?

Ready to Step In?

You’re not just getting a card. You’re getting access.

Rates and Fees

Rates and fees vary depending on the Credit Card you choose. Download this easy-to-follow guide and choose the card best suited to your needs.

Platinum Plus Card Terms & Conditions

First Global Bank Card may at any time revise these terms by updating this document. Please visit this section to review the current terms from time to time.

© 2025 First Global Bank Jamaica Limited. All rights reserved.

2 St. Lucia Avenue, Kingston 5 Jamaica W.I

28-48 Barbados Avenue, Kingston 5 Jamaica W.I..

888-CALL-FGB (225-5342)

COMPANY

LEGAL

FOLLOW US

Copyright 2026. First Global Bank Limited. All Rights Reserved.